So, You Want To Be an Association Treasurer?

Please note: This blog article originally appeared on the Acri Community Realty Blog and is shared with permission of Acri Community Realty. For more information and to contact Acri Community Realty, please scroll to the end of this article.

The Association Board member that is elected as Treasurer holds one of the most important positions within your association.

The Role of the Treasurer

The association treasurer is responsible for maintaining the finances and ensuring the financial stability of the association. He or she is the financial liaison to auditors, CPAs, brokers, agents, and bankers. This includes a number of duties and responsibilities. If you employ a management company many of these tasks, depending on your contract, will be done for you.

The Treasurer’s Role and Their Responsibility

1. Prepare the Budget

The most important responsibility the treasurer has is preparing the annual operating budget.

2. Maintain Association Accounts

The association’s documents and bylaws specify a number of financial responsibilities that the treasurer must oversee.

- Route correspondence to appropriate association representatives—manager, office, board member, committee chair, etc.

- Ensure that tone, form, and spelling of all association correspondence reflect positively on the association.

- Maintaining adequate insurance coverage.

- Keeping financial records.

- Investing association funds.

- Collecting assessments and delinquencies.

- Reserving funds for future needs.

- Filing income tax returns.

3. Understand Basic Financial Statements

Business Budget Planning the treasurer must understand the basic components and definitions of the financial statement:

- Assets

- Liabilities

- Members’ equity: reserves and operating fund balance

- In addition, it would be advantageous to the association if the treasurer also had an understanding of the other components of the financial statement such as:

- Initial working capital

- Special project funds

- Income statement

- Statement of cash flow

4. Report to the Board

The treasurer should report at regular board meetings on the state of the association’s finances. Reports should be based upon factual information compiled from statements and receipts. This information may also be maintained and provided by the property manager or finance committee.

- Balance sheet

- Statement of income

- Cash receipts and cash disbursements activity

- Unit owner balances

- General ledger activity and journal entries

- Schedule of accounts payable

- Bank statements and bank reconciliations

- Reserve Account

5. Implement a Reserve Program

Reserves are a primary responsibility of the treasurer and the board of directors.

The treasurer must:

- Conduct reserve studies.

- Update the reserve study yearly.

- Develop and implement a reserve funding schedule.

- Fund the reserve accounts accordingly to meet goals.

6. Select a CPA and conduct an Audit

Ensuring that the association is working with a qualified certified public accountant (CPA) is one of the treasurer’s important duties.

CPAs with community association experience are better equipped to provide the expertise you need. The treasurer should work with the CPA to perform an annual audit. An annual audit is a very important document for a community association, the management company, and the board. Even if your association uses the services of a CPA, or if your treasurer is a CPA, all board members—especially in self-managed associations—should have a basic understanding of community association finances.

7. Bookkeeping

In smaller, self-managed communities, the treasurer’s duties may include bookkeeping.

8. Financial Liaison

The treasurer is the liaison between the association board and finance committee, its subcommittees, and between the board and the members on financial matters. In addition, the treasurer is the liaison to reserve study engineers, bankers, CPAs, insurance agents, investment brokers, and auditors.

9. Maintain Records

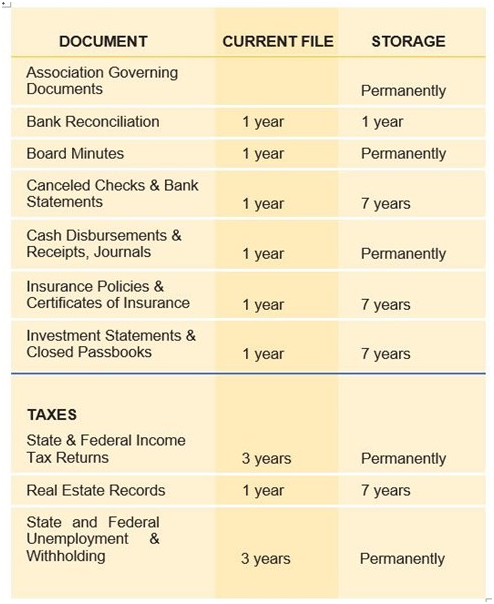

The treasurer should make sure that important financial records are safely maintained in the proper location and for the appropriate length of time.

The image below outlines some of the industry standards for maintaining the Association’s financial records.

Just like the President, the Board Treasurer has a fiduciary obligation to protect the community association.

The position of association Treasurer is not for everyone. Luckily, even the Treasurer has the Board to lean on for support. Many associations have their Management Company perform many of these tasks, especially for compliance purposes.

Whereas the President is the voice, and the Secretary is the heart, the Board’s Treasurer is the blood flow for the entire Association.

Thank you to Acri Community Realty, Rinaldo Acri, and Michele Roper for graciously granting us permission to share this blog post from their website. For more information or to contact Acri Community Realty, please click on the logo, below: